As strange as it may seem, only a small percentage of Americans can legally invest in most startups today. Under long-standing rules governing who qualifies as a so-called “accredited investor,” only quite wealthy individuals (those make at least $200,000 in annual income or have $1 million in assets, excluding their home) can buy shares in a fast-growing, privately held company. This “accredited investor” definition is extremely important for the startup ecosystem, since the most common legal arrangement that startups use to raise funds limits participation almost exclusively to accredited investors. Granted, the landscape of investor participation in funding startups may be changing thanks to the JOBS Act. What’s being referred to as “regulation crowdfunding” is set to go live in May, allowing startups to accept not just monetary donations, but securities-backed investments, from online supporters, regardless of their income. Nonetheless, as many industry experts have argued, the regulatory requirements for both issuers and investors participating in this new form of crowdfunding may limit its full potential. Because regulation crowdfunding will be costly and restrictive for most issuers, many entrepreneurs may opt to instead rely on traditional accredited investors to raise capital, whether in the form of venture capital or angel investments.

As strange as it may seem, only a small percentage of Americans can legally invest in most startups today. Under long-standing rules governing who qualifies as a so-called “accredited investor,” only quite wealthy individuals (those make at least $200,000 in annual income or have $1 million in assets, excluding their home) can buy shares in a fast-growing, privately held company. This “accredited investor” definition is extremely important for the startup ecosystem, since the most common legal arrangement that startups use to raise funds limits participation almost exclusively to accredited investors. Granted, the landscape of investor participation in funding startups may be changing thanks to the JOBS Act. What’s being referred to as “regulation crowdfunding” is set to go live in May, allowing startups to accept not just monetary donations, but securities-backed investments, from online supporters, regardless of their income. Nonetheless, as many industry experts have argued, the regulatory requirements for both issuers and investors participating in this new form of crowdfunding may limit its full potential. Because regulation crowdfunding will be costly and restrictive for most issuers, many entrepreneurs may opt to instead rely on traditional accredited investors to raise capital, whether in the form of venture capital or angel investments.

Source: The SEC could change the requirements for investing in startups, and that’s not good | TechCrunch

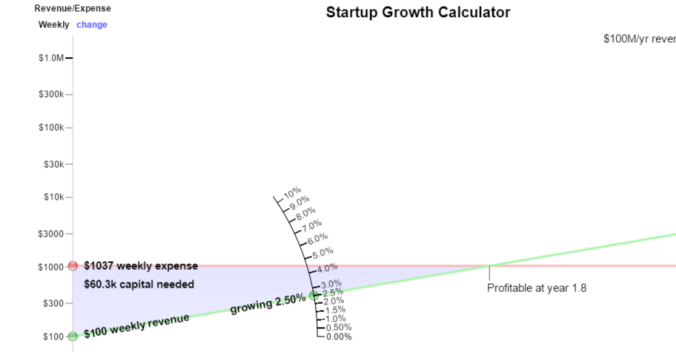

This tool calculates how much funding your startup needs. Assuming your expenses are constant and your revenue is growing, it shows when you’ll reach profitability and how much capital you’ll burn through before then. Once you’re profitable, you control your destiny: you can raise more to grow faster if you want. You can drag the red or green handles to set expense, revenue and growth. Geometrically, the capital needed is the blue-shaded area between the revenue and expense curves. If you raised exactly the amount calculated and everything goes as expected, your bank account would be at $0 the month you hit profitability, which is kind of stressful. So raise a comfortable margin above it. By default it shows weekly rates, but there’s a button to use monthly or yearly rates. The code is on github if you’re curious how it works.

This tool calculates how much funding your startup needs. Assuming your expenses are constant and your revenue is growing, it shows when you’ll reach profitability and how much capital you’ll burn through before then. Once you’re profitable, you control your destiny: you can raise more to grow faster if you want. You can drag the red or green handles to set expense, revenue and growth. Geometrically, the capital needed is the blue-shaded area between the revenue and expense curves. If you raised exactly the amount calculated and everything goes as expected, your bank account would be at $0 the month you hit profitability, which is kind of stressful. So raise a comfortable margin above it. By default it shows weekly rates, but there’s a button to use monthly or yearly rates. The code is on github if you’re curious how it works. The following is a clip from the blog of my new “must read” blogger, Steven Dresner founder of

The following is a clip from the blog of my new “must read” blogger, Steven Dresner founder of  Product Benefits: The healthcare industry is moving away from using symbols in charting and going electronic at the same time. This presents a problem and frustration for healthcare personnel who do charting at the point of care, because most are not typists and they miss the convenience of using symbols to do their work. The msPad will allow medical professionals to enter data using the symbols they are accustomed to. The keypad is designed to be extremely user friendly! Tips and Tricks: Symbols that mean more than one word, tap once for first word, twice for second word, etc. The Actual Keypad: Actual cord length would be 24-28 inches The blue digits are actually a backlite so you can see at night or dim lighting. The green logo at the top of pad is also backlite in green to let you know power is on. Currently working with PAPPS (Parallel-Processing Apps) for product development! Contact: heyluckum@charter.net

Product Benefits: The healthcare industry is moving away from using symbols in charting and going electronic at the same time. This presents a problem and frustration for healthcare personnel who do charting at the point of care, because most are not typists and they miss the convenience of using symbols to do their work. The msPad will allow medical professionals to enter data using the symbols they are accustomed to. The keypad is designed to be extremely user friendly! Tips and Tricks: Symbols that mean more than one word, tap once for first word, twice for second word, etc. The Actual Keypad: Actual cord length would be 24-28 inches The blue digits are actually a backlite so you can see at night or dim lighting. The green logo at the top of pad is also backlite in green to let you know power is on. Currently working with PAPPS (Parallel-Processing Apps) for product development! Contact: heyluckum@charter.net Control’s Force was founded by Dr. Boris Shapira, a hi-tech technology entrepreneur with a proven track record, after his previous company had been acquired by EMC in 2006. In response to increased market demand Control’s Force was created to realize new aspects of Dr. Shapira’s data-centric process modeling concept.

Control’s Force was founded by Dr. Boris Shapira, a hi-tech technology entrepreneur with a proven track record, after his previous company had been acquired by EMC in 2006. In response to increased market demand Control’s Force was created to realize new aspects of Dr. Shapira’s data-centric process modeling concept.